Alexandria Carr, Punter Southall Law Partner, casts her expert eye over new FCA consumer duty

We are all going to be impacted by the FCA’s new Consumer Duty which comes into force in July 2023 because the new rules and guidance set a new standard of care for consumers in the retail financial services sector.

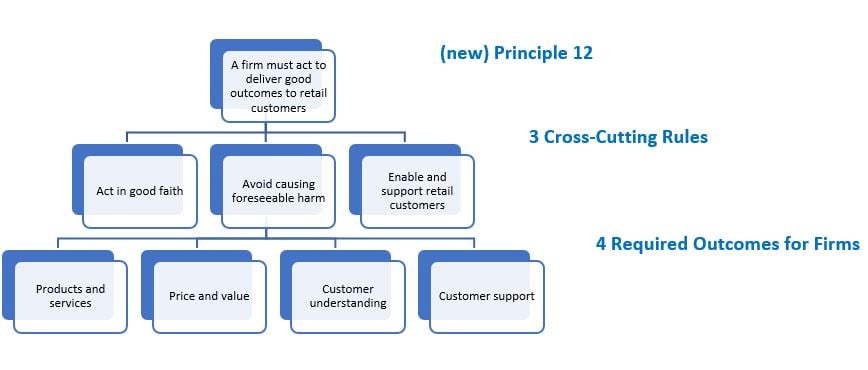

This diagram illustrates how the new standard of care will be achieved:

As a consumer, it is intended to ensure that I get the right financial products at the right price and that I get the right level of support from the financial institution that is working for me. And it is not only sophisticated investment products that are in scope: the Consumer Duty covers those financial products that many of us have – bank accounts, credit cards, mortgages, loans, house insurance, motor insurance.

For the financial services sector - retail and investment banks, building societies, credit unions, insurers, insurance brokers, asset managers, investment managers, fund managers, wealth managers, financial advisers, payment institutions, claims management companies - the Consumer Duty brings both challenges and opportunities: challenges because there is a lot of work for financial institutions to do to get ready for the Duty but also opportunities as firms who get it right will retain customers and attract new ones.

The purpose of the new duty is to ensure that firms take into account the likely outcomes their customers will receive throughout a product’s full lifecycle - the likely outcomes their customers will receive throughout the lifecycle of a financial service product or service. Firms will be required to monitor, assess, understand and be able to evidence the outcomes their customers are receiving and where firms identify that consumers are not receiving good outcomes, they should take appropriate action to rectify the causes and, where necessary, remediate.

There are also new rules and guidance on governance and culture, monitoring, redress and a new conduct rule. A new conduct rule 6 will require all conduct rules staff to “act to deliver good outcomes for retail customers” where the activities of the firm fall within the scope of the Consumer Duty.

The FCA is introducing new rules that will impact any UK regulated financial institution which can materially impact the outcome retail customers experience from regulated retail financial products.

This is important because it means that financial services firms are in scope of the Consumer Duty not only if they deal directly with retail customers but also if they play a role in a “distribution chain” which allows them to “determine or materially influence” the outcome experienced by an end retail customer.

A good example of this is where an insurance broker sells home insurance underwritten by an insurer to retail customers. In this case, both the broker and the insurer are in scope of the Consumer Duty even if the insurer does not have direct contact with the customer. The broker distributes a product (the insurance policy) to the retail customer but the insurer has manufactured and designed the product distributed to retail (i.e. the retail distribution chain). As such, the insurer will inevitably have a material impact on the customer outcome.

The concept of determining or having material influence over a retail customer outcome is a new one and there is no definitive test to determine material influence. It will depend on the product, a firm’s role in the distribution chain and the extent to which it has discretion over customer outcomes, particularly the four outcomes highlighted by the FCA (illustrated above).

A firm’s “retail market business” is in scope of the Consumer Duty. That definition encompasses mass retail financial services products – bank accounts, credit and debit cards, home insurance, motor insurance, travel insurance, pet insurance, consumer loans, mortgages etc - but also investment products designed for retail customers.

Whilst wholesale products and activities are excluded from the definition of “retail market business” there are inevitably products in the grey area where careful consideration will be necessary to determine whether or not they are in scope. For example, activities connected to the distribution of group insurance policies or the extension of these policies to new members are explicitly carved out of scope but only if the firm does not have direct contact with a person covered by that group policy.

The simple answer is that “retail customers” are protected but defining a retail customer is not straight-forward. The definition differs according to the product or activity being provided.

The Consumer Duty does not apply to firms or activities outside the remit of the FCA, for example, pension schemes regulated by the Pensions Regulator. However, by including beneficiaries of occupational pension schemes in the definition of retail customers, the FCA has ensured that it does apply to firms who deal with pension scheme trustees.

Firms need to be ready for 3 deadlines:

The FCA has advised: “We do not expect firms to have necessarily fully scoped all work required to embed the Duty by the [31] October deadline, but we do expect firms to have set out how they will do so in time to ensure timely implementation.”[2]

In the next in our series of Consumer Duty briefings we will look at the requirement for manufacturers to have completed all the reviews necessary to meet the outcome rules for their existing open products and services by the April deadline and the information they need to share with their product distributors.

[1] The Consumer Duty comes into force for new and existing products that are open to sale or renewal on 31 July 2023 and for closed products on 31 July 2024. Closed products are those that are no longer marketed or distributed to retail customers or open to renewal.

At Punter Southall, we have a team of highly skilled risk, compliance and legal experts with deep in-house practical experience. Get in tough if you would like a friendly chat with one of us.

Where we share what we’re thinking about and what conclusions can be drawn on everything from the work we do to the world around us. We hope you find our posts readable, relevant and thought-provoking.

SubscribeInsights