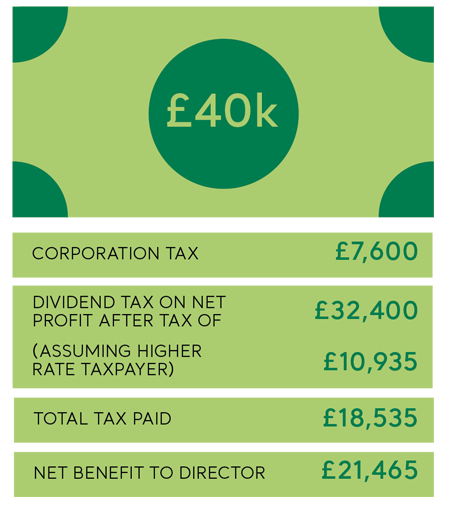

When your company generates a healthy profit, few things say “thank you” to shareholders quite like distributing dividends. In 2022-23, tax on dividends has been raised by 1.25% but the rates are still lower than those on income tax.

A Higher Rate taxpayer pays 40% on income that falls between £50,271 to £150,000, but 33.75% on dividend income within this bracket. It may be wise to discuss planned dividends with other major shareholders, especially considering the reduction in allowances from April 2023.

Pay into company pensions

If your business has employees, the UK’s automatic enrolment rules mean that you have a legal duty to offer a workplace pension and put certain employees into it, with minimum pension contribution requirements to meet.

When you generate consistent healthy profits, this can be a great opportunity to reward your staff - and encourage retention - by boosting your employer pension contributions, e.g. by 1% or 2%. This is also tax-efficient for the company as the contributions are treated as an expense (reducing corporation tax on profits) and you do not need to pay National Insurance on them.

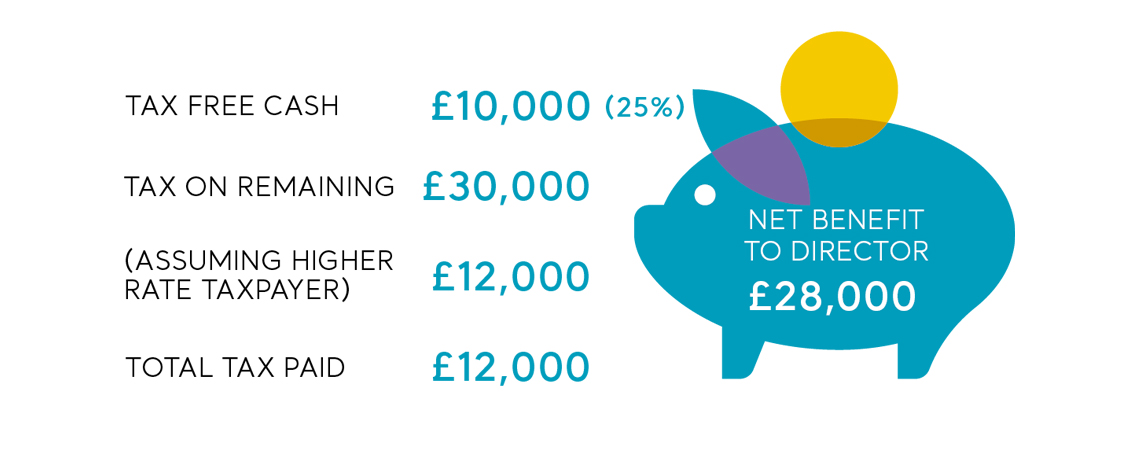

If the same amount were paid into the director’s pension, no corporation tax would be due as there would be no company profit. Twenty five per cent can be withdrawn tax free with what remains subject to income tax but leaving the remainder invested for a number of years means also benefiting from any tax-free growth in the pot.

For a company with profits in excess of the need to pay dividends, the option of making pension contributions is very attractive, and that’s before you consider pensions sit outside the scope of inheritance tax.

As you may be aware, it is not normally possible to access pension pots until you are 55 - rising to 57 in 2028. Running a business means you generally need to maintain liquidity within the company to allocate money for future investment.

This may make large pension contributions seem a luxury or a less immediate way of accessing any profit but it does highlight the potential for you to fund your pension, save tax and still support the growth of your company. And just imagine if you could then make your pension work even harder for both your benefit and business.

Certain pension schemes come with the ability to lend money to the organisations with which they are linked. By doing so, interest on the borrowing would be paid back into the pension scheme - rather than another lender like a bank - meaning you potentially profit twice from the growth of the business.

This facility has been available for a number of years but is under-appreciated and under-utilised.

We already help many business owners with their pension planning in this way.

Contact us to understand how we can do the same for you.

At Punter Southall, we have a team of highly skilled risk, compliance and legal experts with deep in-house practical experience. Get in tough if you would like a friendly chat with one of us.

Where we share what we’re thinking about and what conclusions can be drawn on everything from the work we do to the world around us. We hope you find our posts readable, relevant and thought-provoking.

SubscribeInsights