Steve Butler, CEO of Punter Southall Aspire reflects on the meaning of 'E' in ESG

ESG, or to give it its full designation, Environmental, Social and Governance, is rarely out of the news when it comes to pensions and investments. In some respects, what is a significant movement towards ensuring investment practise and outcomes are aligned with long-term, beneficial impact for not only investors but the wider world beyond is not always easy to pin down. So I thought I would turn my blog over to individual posts on the E, S and G respectively to articulate a little more what they stand for. Punter Southall Aspire’s chief executive, Steve Butler, starts us off with a view on the Environmental.

I ask the question which forms the headline rhetorically for three reasons.

Has what started out as an enlightened, socially-responsible -and responsive – methodology for allocating assets and taking a pro-actively constructive approach become ubiquitous without remaining impactful?

Is it now simply a label pasted on to a multitude of investments, regardless of what its inclusion actually reveals about said investment? Has it simply joined the various kite marks, boiler plate and rubric of the everyday when it was designated as anything but?

And have recent events applied very real pressure on the not only noble yet intensely pragmatic ambition which underpins this movement? Is war in Europe and the pandemic a sign for the superstitious, and the eternal sceptics, that everything has reverted to a darker, less optimistic world order?

We don’t think so. In our view, ESG is a global force for good, marshalling the power of apex capital in service of a cleaner, greener planet and more equitable society. Or, closer to home, the power of your pension to contribute to making our world a better place for all of us.

My quibble is that the E in the acronym tends to garner the lion’s share of attention. Given that the global movement to combat climate change has worldwide recognition, maybe that’s not surprising.

The impact of the S for social in ESG and G for governance is what binds together these elements into something which is becoming established and unstoppable.

But try as we might, E is the Hollywood factor in ESG. After all, how many of us are left floored by the epic power of David Attenborough’s spectacular wildlife documentaries and their accompanying context that humans need to do more to protect the planet? Can the same claim be made for a putative film putting governance under the spotlight? If so, step forward the next Stephen Spielberg.

That instance alone demonstrates just one of the obstacles facing the further adoption of ESG and was the spark behind this blog and others to follow, namely: how do you capture the public imagination for something often lazily labelled “important but opaque”?

With difficulty might be the honest answer but, as we know in pensions, a complex subject that can be hard to grasp means we need to be imaginative, creative and determined to connect with the companies and clients we serve.

The reality that the E is something far more visible to far more people, resulting in S and G being thrown into sharp relief by contrast. There’s also the issue of sheer scale – so much is encompassed by this acronym.

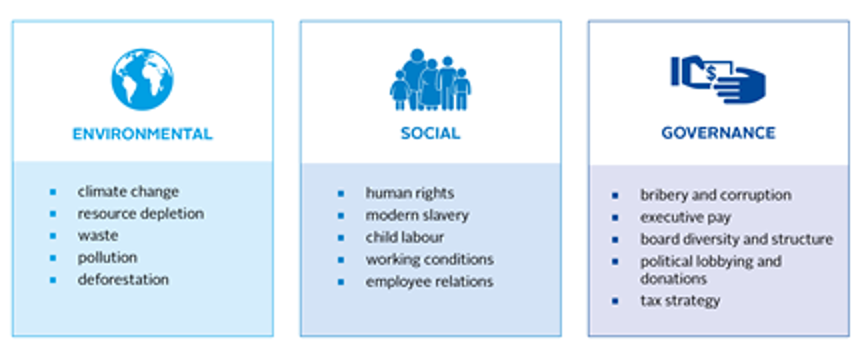

In graphic form, according to the Principles for Responsible Investment, it’s a bit more recognisable.

But still imbalanced in terms of instant comprehension and curiosity. Is deforestation easier to visualise than the uncomfortable images evoked by child labour, let alone what tax strategy brings to mind?

What is clear is there’s little point in reversing climate change and cleaning up the planet if human rights and working conditions go the other way, nor tackling bribery and corruption if political lobbying and donations go unchecked.

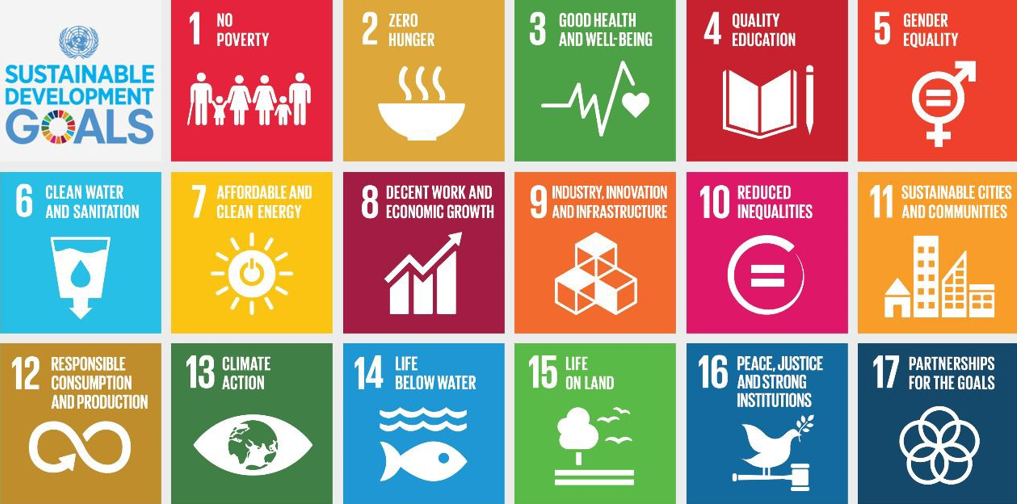

And how does it feed into the UN’s stated goals? All informed by ESG?

I’m not pretending I have the answers but as pension consultants, employee benefits experts and health and protection specialists, not to mention chartered financial planners and concerned citizens, we will continue to ask questions.

Hopefully, I have set at least some context for the next blog, which will look at the S before we come to the G in ESG. It’s a conversation worth continuing.

At Punter Southall, we have a team of highly skilled risk, compliance and legal experts with deep in-house practical experience. Get in tough if you would like a friendly chat with one of us.

Where we share what we’re thinking about and what conclusions can be drawn on everything from the work we do to the world around us. We hope you find our posts readable, relevant and thought-provoking.

SubscribeInsights